Update schedule

We're updating our forecasts on a quarterly basis, at the start of each calendar quarter we'll update the portal with the latest figures.

Methodology

Megamodel: our global data model

The quantitative market data comes from our unique model of the global professional services market.

Rather than making high-level assumptions, this model has been built from the bottom up, sizing the market capability by capability—assessing how much work a firm earns delivering each professional capability within each sector and country. This results in a robust view of the size of the supply-side market, which can then be broken down to view the size of the market by country, sector, line of business, capabilities, and market segments.

This year’s model has been expanded, with a new capability taxonomy and a much broader range of professional services firms included— all of which reflects convergence and other changes we see in the industry. For the purposes of this report we’ve focused on types of firm and market segments that broadly equate to traditional definitions of consulting. As a result of these changes to our methodology, there are changes to our market sizing data, which take into account that conventional consulting firms now compete in many non-consulting markets—in essence that their addressable market is larger. Historic data has been restated to match our new definitions, but the inclusion of new types of firm and additional services may also have an impact on growth rates.

Alongside this market segmentation, we also limit our market sizing and analysis to what we at Source call “big consulting”—work done by mid-and large-sized firms (those with more than 50 people). Please note that we don’t track the long, thin tail of work done by contractors and very small firms, as most readers of this report would not seek or be able to compete in this part of the market.

All of the data in the model is calibrated through extensive interviews with, and surveys of, professional services firms and their clients, allowing us to discuss broader trends in the market alongside detailed dimensions such as headcount. These interviews and surveys are supplemented with desk research, which allows us to assess the impact of wider macroeconomic trends on professional services. This, combined with our detailed modeling, results in a long-term view of the market that is able to support both historic and forecast data.

Glossary

- Albania

- Algeria

- Angola

- Argentina

- Australia

- Austria

- Bahrain

- Belarus

- Belgium

- Bosnia

- Brazil

- Bulgaria

- Cameroon

- Canada

- Chile

- China

- Colombia

- Côte d'Ivoire

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Egypt

- Ethiopia

- Finland

- France

- Germany

- Ghana

- Greece

- Hong Kong

- Hungary

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Japan

- Kenya

- Kuwait

- Lebanon

- Libya

- Luxembourg

- Malaysia

- Mexico

- Morocco

- Mozambique

- Myanmar

- Netherlands

- New Zealand

- Nigeria

- North Macedonia

- Norway

- Oman

- Pakistan

- Papua New Guinea

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Serbia

- Singapore

- Slovakia

- Slovenia

- South Africa

- South Korea

- Spain

- Sri Lanka

- Sudan

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Tunisia

- Turkey

- UAE

- Uganda

- Ukraine

- United Kingdom

- United States

- Venezuela

- Vietnam

- Zambia

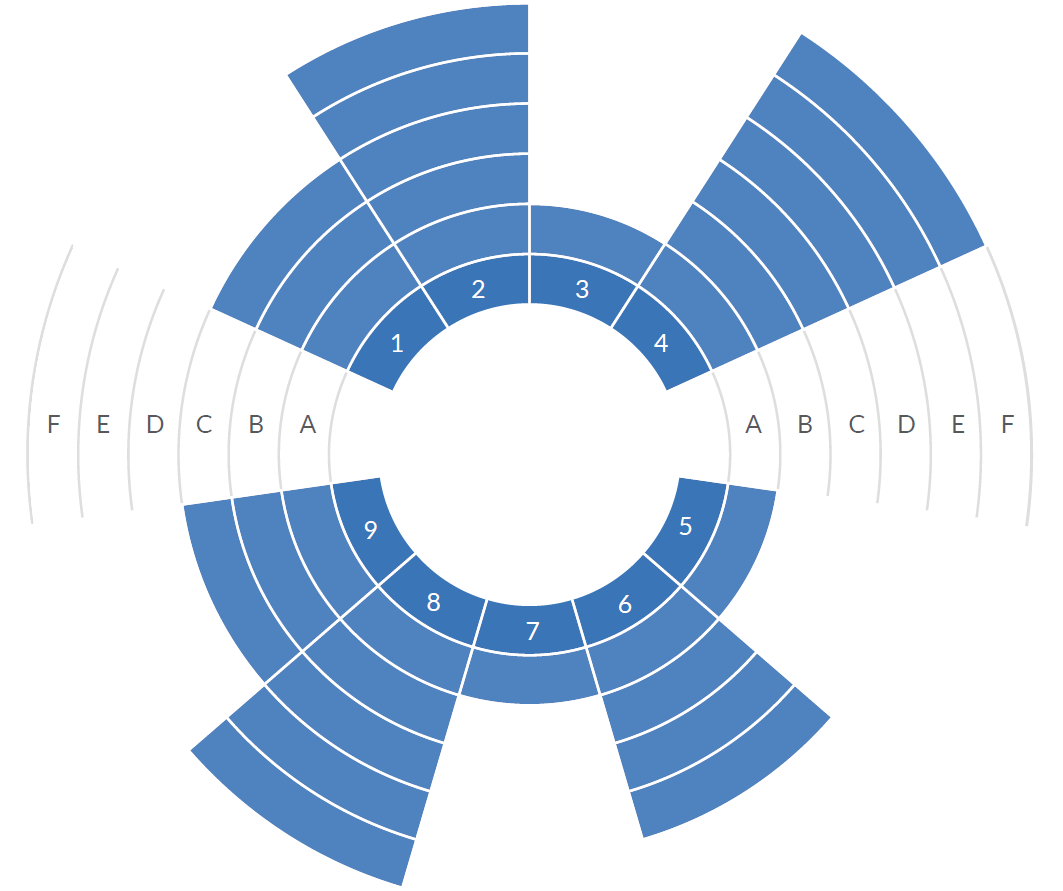

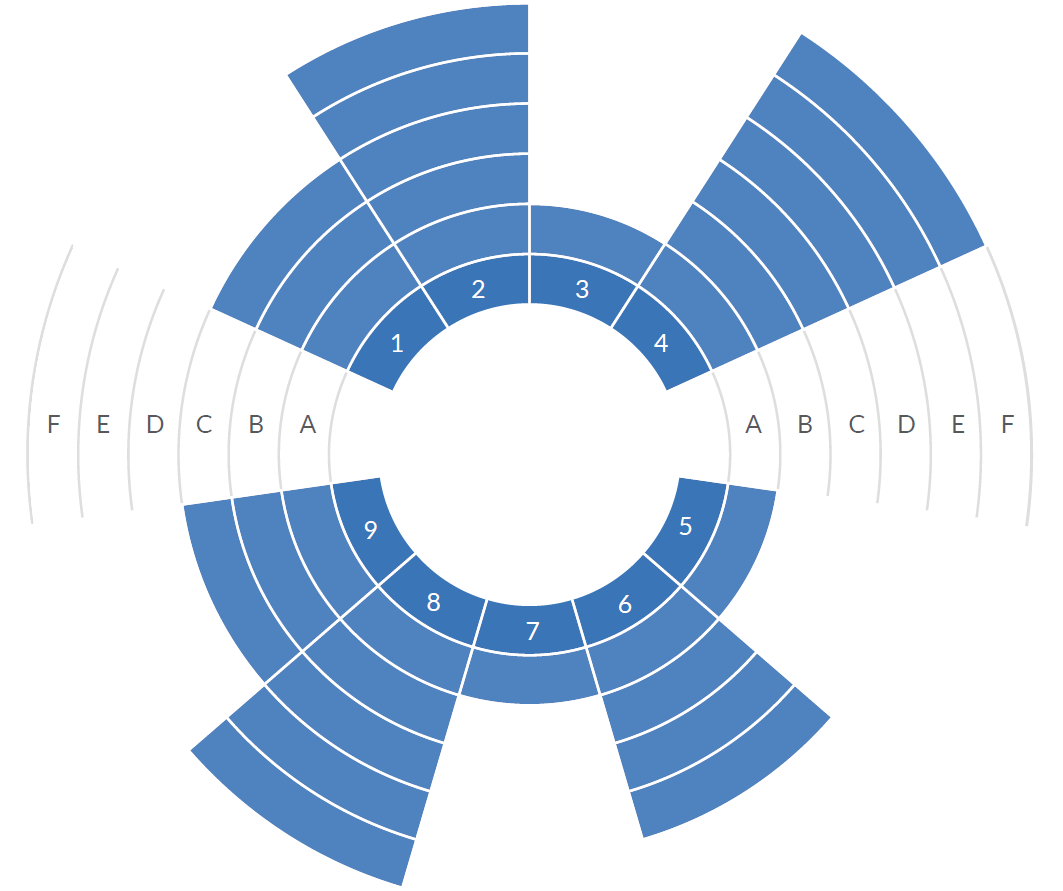

| Lines of Business |

| 1 |

Cybersecurity |

| 2 |

Risk |

| 3 |

Forensic |

| 4 |

Financial management |

| 5 |

Design & UX |

| 6 |

Innovation |

| 7 |

Technology |

| 8 |

Data & analytics |

| 9 |

Research |

| 10 |

Deals |

| 11 |

Strategy |

| 12 |

Real estate |

| 13 |

Operations |

| 14 |

Sustainability |

| 15 |

HR & change |

| 16 |

Architecture |

| 17 |

Audit & assurance |

| 18 |

Business process outsourcing |

| 19 |

Civil engineering |

| 20 |

Legal |

| 21 |

Litigation |

| 22 |

Marketing & creative |

| 23 |

Network engineering |

| 24 |

Product engineering & R&D |

| 25 |

Recruitment |

| 26 |

Sof tware engineering |

| 27 |

System integration |

| 28 |

Tax |

|

| Capabilities |

- 1ACybersecurity advice

- 1BCybersecurity incident response

- 1CPenetration testing & wargaming

- 2ATechnology & securit y risk services

- 2BOperational risk

- 2CProgramme risk

- 2DResponding to regulation

- 2ERisk management

- 3AeDiscovery

- 3BForensic accounting

- 4ABudgeting/financial planning process

- 4BDebt advisory

- 4CFinance function

- 4DFinancial advisory

- 4EFinancial restructuring & insolvency

- 5ACorporate identity

- 5BCustomer journey & UX benchmarking

- 5CGraphic & UI design

- 5DUX & service design

- 6AIdeation

- 6BInnovation management

- 6CInnovation strategy

- 6DStrategies for growth from innovation

- 7ACloud advice

- 7BERP consulting

- 7CIT strategy, planning & review

- 7DIT training

- 7EProgramme management

- 7FVendor selection

- 8AAdvanced analytics

- 8BData visualisation, business intelligence & semantic layer

- 9ACustomer feedback

- 9BCustomer segmentation

- 9CEmployee feedback

- 9DEnvironmental & social impact research

- 9EMacro/microeconomic research

- 9FMarket research

- 10ACapital allocation strategy

- 10BCommercial due diligence & valuation

- 10CFinancial due diligence

- 10DM&A transaction strategy

- 10EOperational due diligence

- 10FPortfolio & investment strategy

- 10GPublic-private partnerships

- 10HTechnology due diligence

- 11ABusiness & financial modelling

- 11BCategory management

- 11CChannel management

- 11DCorporate recovery & turnaround

- 11ECorporate restructuring

- 11FCorporate strategy

- 11GMarket analysis & strategy

- 11HPolicy formulation

- 11IPricing

- 11JStrategic sourcing/offshoring services

- 12ACorporate, occupier services & facilities management

- 12BIntegrated real estate developer services

- 12CReal estate deal/transaction services

- 12DReal estate strategy

- 13ABenchmarking

- 13BBusiness continuity & recovery

- 13CCost cutting

- 13DCustomer service

- 13EDevOps

- 13FDistribution strategy

- 13GLean & Six Sigma

- 13HOperational review

- 13IOutsourcing advice

- 13JPost-M&A integration

- 13KProcess design, re-engineering & automation

- 13LProcurement/purchasing

- 13MProperty & estate management

- 13NSales & distribution planning

- 13OSales force effectiveness

- 13PSupply chain management

- 13QTarget operating model

- 14APurpose-led strategy & change

- 14BResource-efficiency implementation

- 14CResource-efficiency strategy

- 14DSocial impact & trust

- 14ESustainable workforce

- 14FSustainable supply chain

- 14GClean technology

- 14HGreen IT

- 15ABenefits, compensation & pensions, excluding actuarial & investment advice

- 15BChange management

- 15CDiversit y & inclusion

- 15DEmployee engagement

- 15EGovernance & board ef fectiveness

- 15FHR strategy & ef fectiveness

- 15GLeadership

- 15HOrganisational design & culture

- 15IOrganisational training & development

- 15JOutplacement

- 15KPension fund evaluation & advice

- 15LPerformance management

- 15MStakeholder management

- 15NTalent management

- 15OTeam effectiveness & collaboration

|

|

|

| Sectors |

| 1 |

Energy & resources |

| 2 |

Financial services |

| 3 |

Healthcare |

| 4 |

Manufacturing |

| 5 |

Pharma & biotech |

| 6 |

Public sector |

| 7 |

Retail |

| 8 |

Services |

| 9 |

Technology, media & telecoms |

|

| Sub-sectors |

| 1 |

A |

Energy |

| 1 |

B |

Primary resources |

| 1 |

C |

Utilities |

| 2 |

A |

Banking |

| 2 |

B |

Capital markets |

| 2 |

C |

Insurance |

| 2 |

D |

Investment and wealth mana |

| 2 |

E |

Private equity |

| 3 |

A |

Healthcare |

| 4 |

A |

Aerospace |

| 4 |

B |

Automotive |

| 4 |

C |

Construction |

| 4 |

D |

Consumer electronics |

| 4 |

E |

Consumer packaged goods |

| 4 |

F |

Industrial products |

| 5 |

A |

Pharma |

| 6 |

A |

Defence |

| 6 |

B |

Education |

| 6 |

C |

Not-for-prof it |

| 6 |

D |

Public sector |

| 7 |

A |

Retail |

| 8 |

A |

Business services |

| 8 |

B |

Leisure |

| 8 |

C |

Logistics |

| 8 |

D |

Real estate |

| 8 |

E |

Transportation |

| 9 |

A |

High-tech |

| 9 |

B |

Media |

| 9 |

C |

Telecoms |

|